BudgIt

About the Project

Many young adults struggle with taking control of their finances. Despite many recently finishing school, these individuals are not equipped with the right tools for the financial responsibilities that are expected of them, which causes them stress.

BudgIt is an app that connects all aspects of an individual’s finances into one intuitive interface. In addition, it creates a judgment-free space for adults to develop their financial literacy.

Team

Amber

Kayden

Swathi

Tools

Figma

Miro

Trello

UXPressia

Discover Phase

Hypothesis

Millennials and Gen Z’s are not educated well on keeping track of their finances and bills - an app would be very helpful for them.

Research Plan & Interviews

We identified 3 objectives:

Understand the current level of financial education of the average young adult

Discover the tools and methods that young adults currently use to manage their finances

Learn what is most frustrating to young adults about managing their own finances

Next, we came up 17 questions and had 1-1 interviews with 6 potential users. After the interviews, we sorted the qualitative data into what we saw as the most important categories to get a better understanding of how people currently deal with their financial situation.

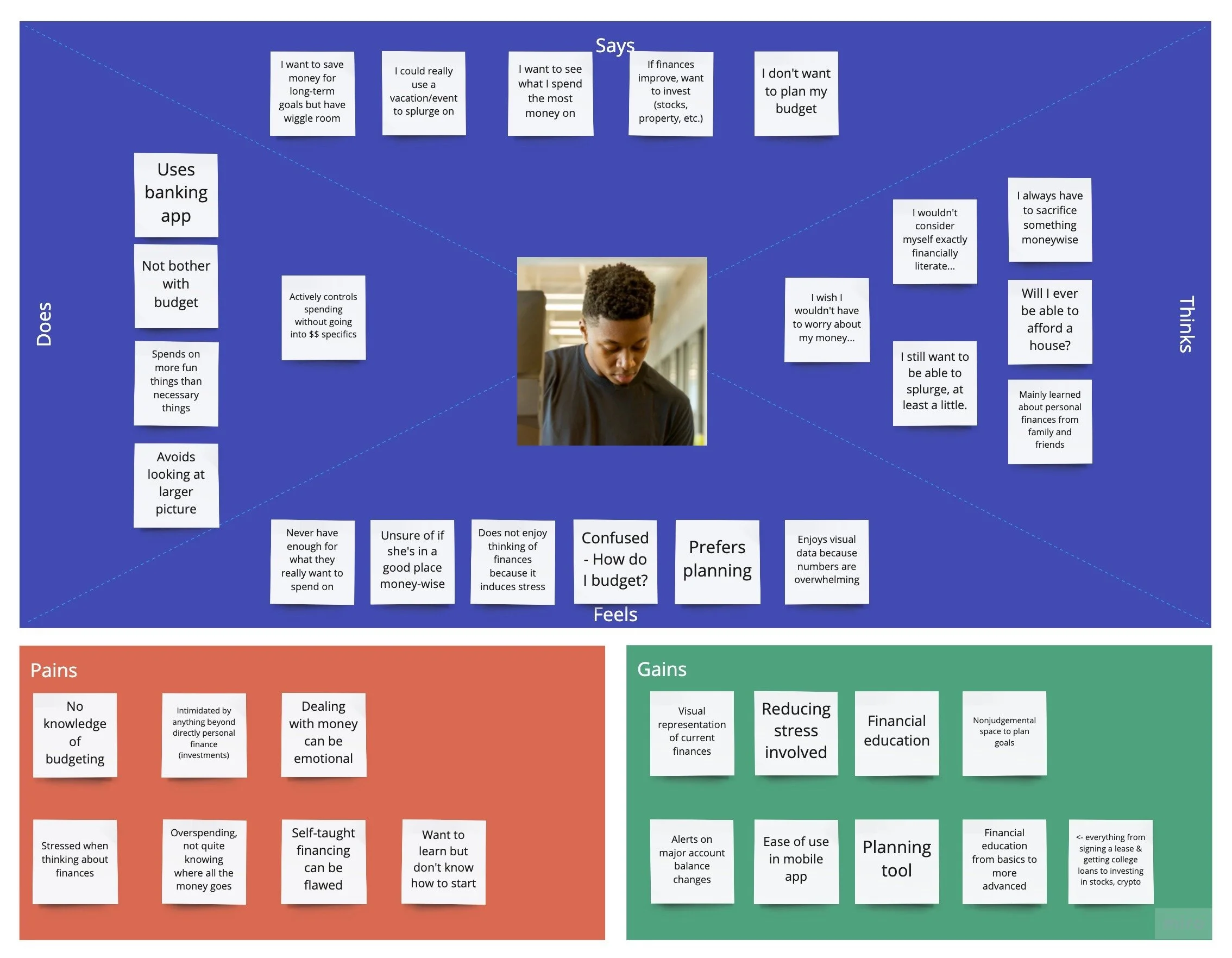

Empathy Map

We developed an empathy map to explore how a potential user will think and behave, as well as main pains and gains from a potential financial app solution.

User Persona

Below is Robert Estrada, new to the workforce and apartment life. He, like those we interviewed, has some issues overspending and not knowing how to budget. To help him and others like him meet their goals, we began to ideate on ideas we had for the solution.

Define Phase

Competitor Analysis

We focused on the Mint & Credit Karma mobile apps as direct competitors and a financial advisor & a college education as indirect competitors. While we were mainly looking to consolidate banking information, we also want to focus the app on expanding financial literacy.

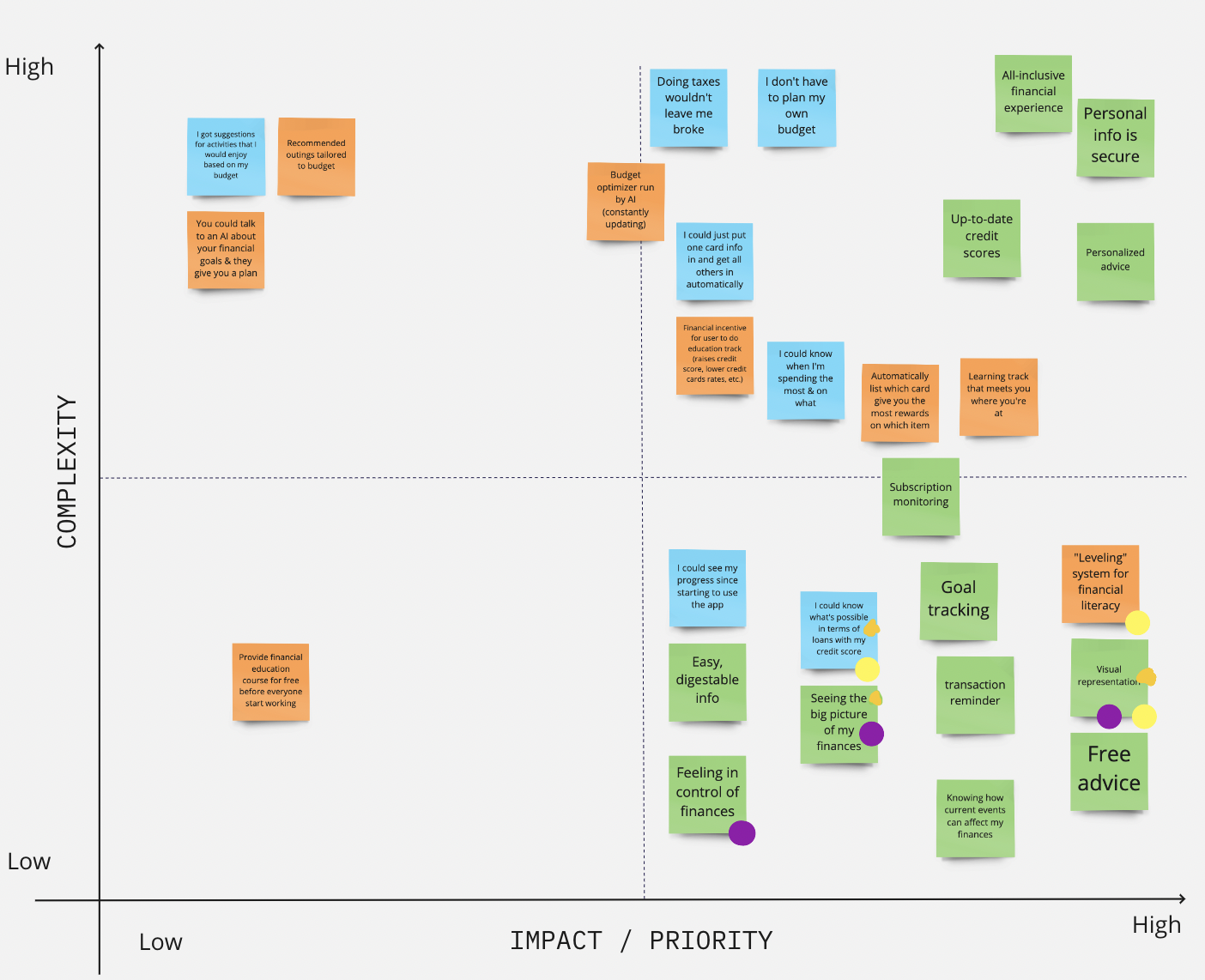

Feature Prioritization

This technique of prioritizing solution features helped us realize that there were more vital aspects of money management than we originally anticipated. We each voted on our top 5 options and charted these insights based on complexity and impact/priority to the user.

I Like, I Wish, What If Method

We explored ideas with a brainstorming technique. We focused on the question, how might we take the stress out of managing a budget?

Storyboard

After learning that student loan payments are due soon, Robert realizes that he needs to take control of his finances.

User Task Flow

We developed a task flow of how a user can travel through the app, given specific tasks like connecting bank info and creating budget goals.

Develop Phase

Affinity Diagram

From the usability tests, we noted key insights and created an affinity diagram. Then, we each voted on our top 5 ideas to include in the next iteration of the prototype (seen with the colored dots below).

Design Guidelines

While iterating the prototypes, we developed a design guideline to follow, including styles and colors. Two out of the three group members have phones that utilize iOS, so we challenged ourselves to design the mobile app utilizing Material Design guidelines.

Lo-Fi Prototype

Below is the lo-fi prototype of the Goals page. It separates short-term & long-term budget goals of the user and shows the progress towards the goals.

Usability Testing

Once we developed the prototype, we created a series of tasks to conduct usability testing. We interviews 6 individuals and gained key insights into improving the app and interface:

Engaging dashboard with more info

Confirmation that tasks are complete (creating account, adding goal)

Make app seem more secure (two-factor authentication)

Bookmarking articles for future use

Adding a support page

“I feel like there’s a lot that I don’t know and I feel like I struggle financially sometimes almost running out of money. So it stresses me out to think about it.”

Feature Prioritization

All key user insights that had at least one vote were charted on a feature prioritization diagram, focusing on priorities for both the user and BudgIt.

Hi-Fi Prototype

Below is the hi-fi prototype of the Goals page that utilizes user insights and design guidelines. The progress bar was modified to a quick alert, with the goals also having progress reports.

Delivery

The video shows a demo of the BudgIt hi-fi prototype. After several iterations, we developed a financial mobile app that is approachable and useful for young adults looking to take control of their finances.

Future Opportunities

Articles of current events have info on how it affects their personal finances

Financial advisors in-app

“Leveling” system for financial literacy

More educational resources

Support helpline